Days until January 1, 2026

- days

- Hours

- Minutes

- Seconds

Registration Form

Now’s the time to create a plan

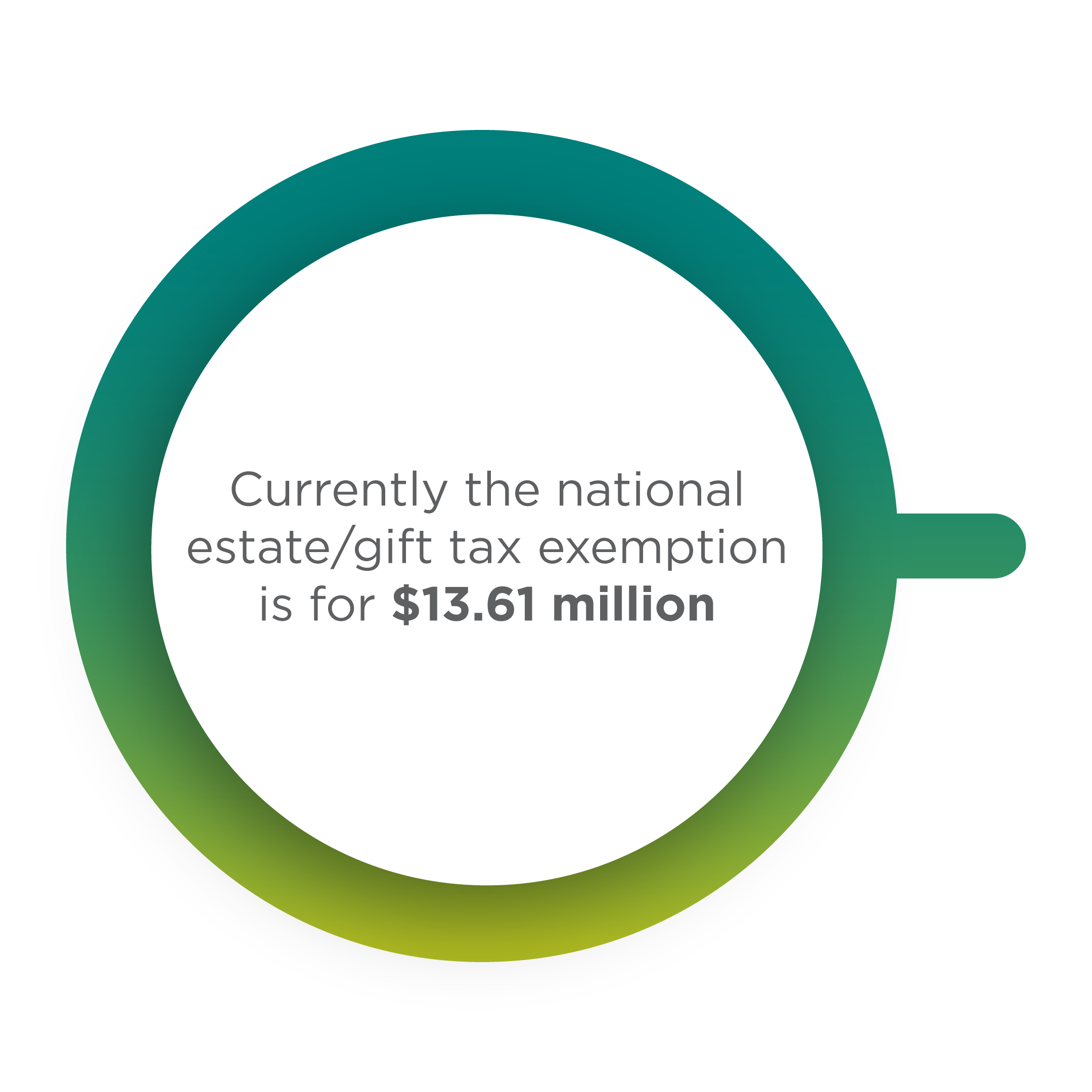

You should be aware, as of January 1, 2026, the estate-and-gift tax exemption, temporarily doubled by the 2017 Tax Cuts and Jobs Act, will end. This will reduce the exemption by half, back to a baseline $5,000,000 (indexed to inflation). This could create major tax implications for your estate plan. Here are a few things to consider:

Check with your financial advisor for your state’s specific rate and to make a plan to better prepare for the upcoming changes to the estate exemption rate.

Estate planning for everyone

There’s no one-size-fits-all way to plan your estate. You want to protect your beneficiaries, preserve what you worked a lifetime for, and maintain the standard of living for your loved ones, while setting them up for the future. Whatever your motivation, there are a variety of factors to consider – here are a few helpful resources to do just that.